ARIZONA TAX CREDIT PROGRAM

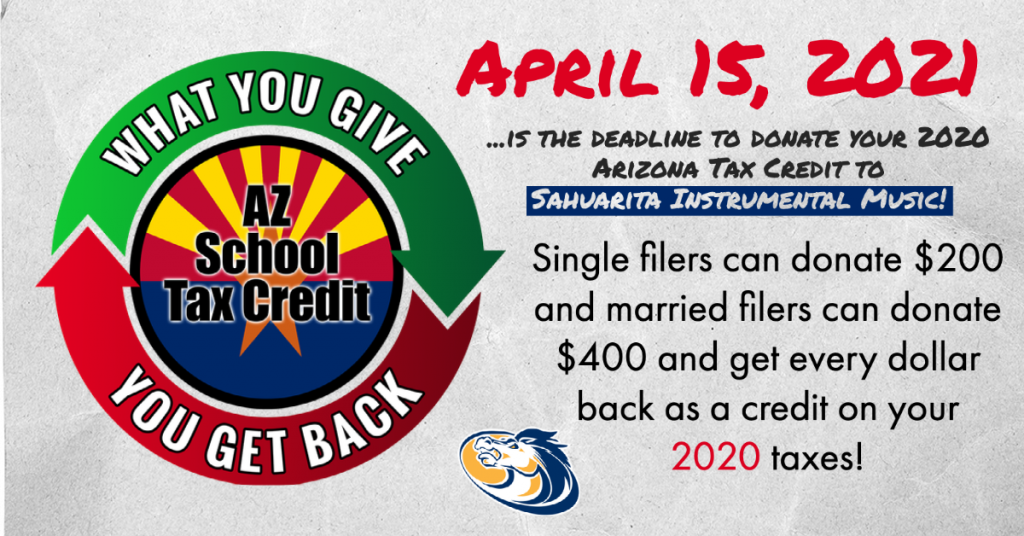

The Arizona Tax Credit program allows every person who files an income tax return with the State of Arizona the opportunity to receive a tax credit for contributing to extracurricular activities. We are asking for you to support the SHS Instrumental Music Program!

If you qualify for this state tax credit, you may write a check or use your credit card to make a contribution. When you file your Arizona state taxes, you then subtract the amount of your contribution from what you owe or add the amount to your refund. Anyone can participate: married or single, with or without children. Married couples filing jointly may claim up to $400. Single persons, heads of households, and married couples filing separately may all claim up to $200. For more information on these Tax Credits visit the Arizona Department of Revenue’s Website or see ARS §43-1089.01 for more information on the law.

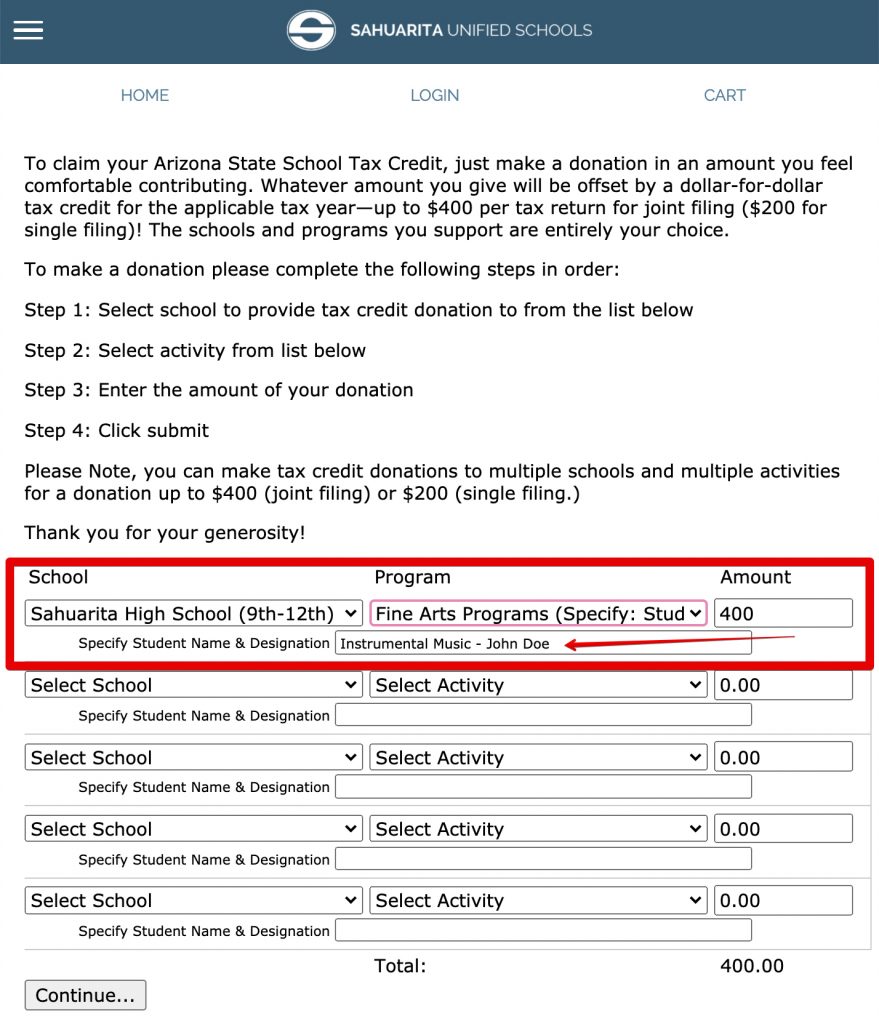

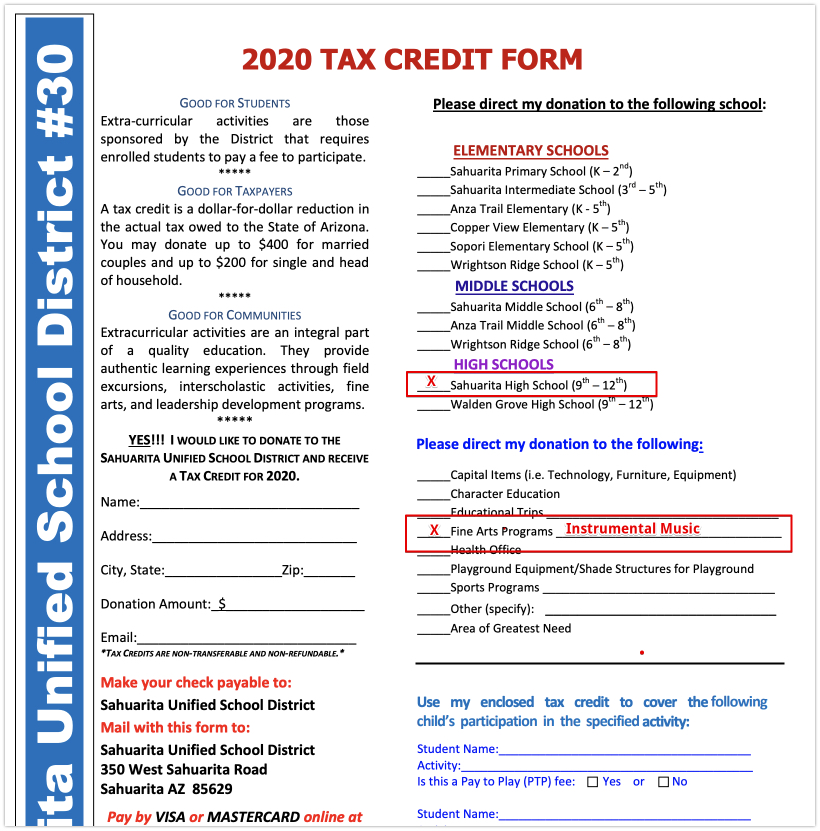

To make your Arizona Tax Credit Donation, go to https://susd30.us/parents/tax-credit/

When filling out the hard copy or online form, be sure to select Sahuarita High School and select “Instrumental Music” as the activity to be sure that your donation goes to support the Sahuarita Instrumental Music Program!